In today’s fast-paced world, where financial markets are evolving rapidly, having access to an efficient and user-friendly trading platform is crucial. One such platform that has gained significant popularity is 5 Paisa, known for its low brokerage fees and diverse investment options.It has been told in this article that How to Create an Account on 5 Paisa In 2024

Table of Contents

I. Introduction

In the financial landscape, 5 Paisa has emerged as a go-to platform for both novice and experienced investors. Creating an account on 5 Paisa is the first step towards exploring the world of online trading. Let’s delve into the process and explore why this platform is a preferred choice.

follow this process and create acount

click this 👇button and follow this process

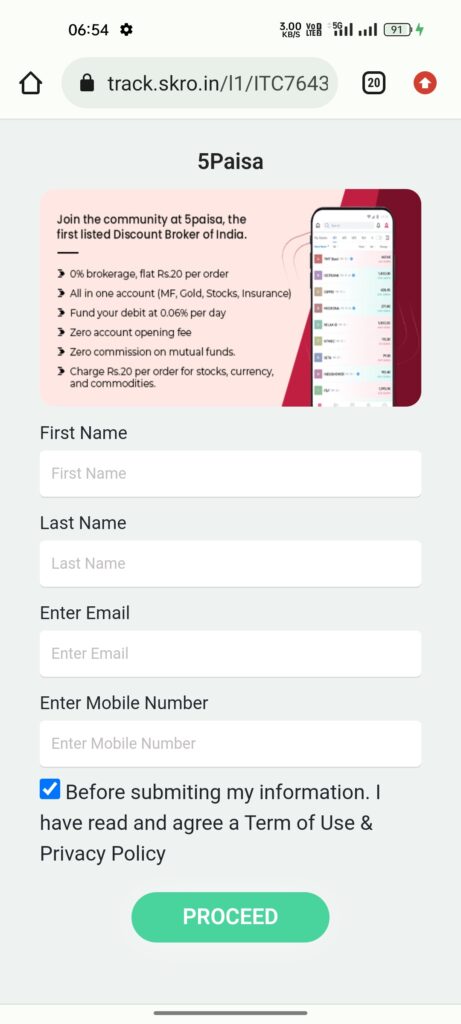

click this button👆and you can show this interface👇

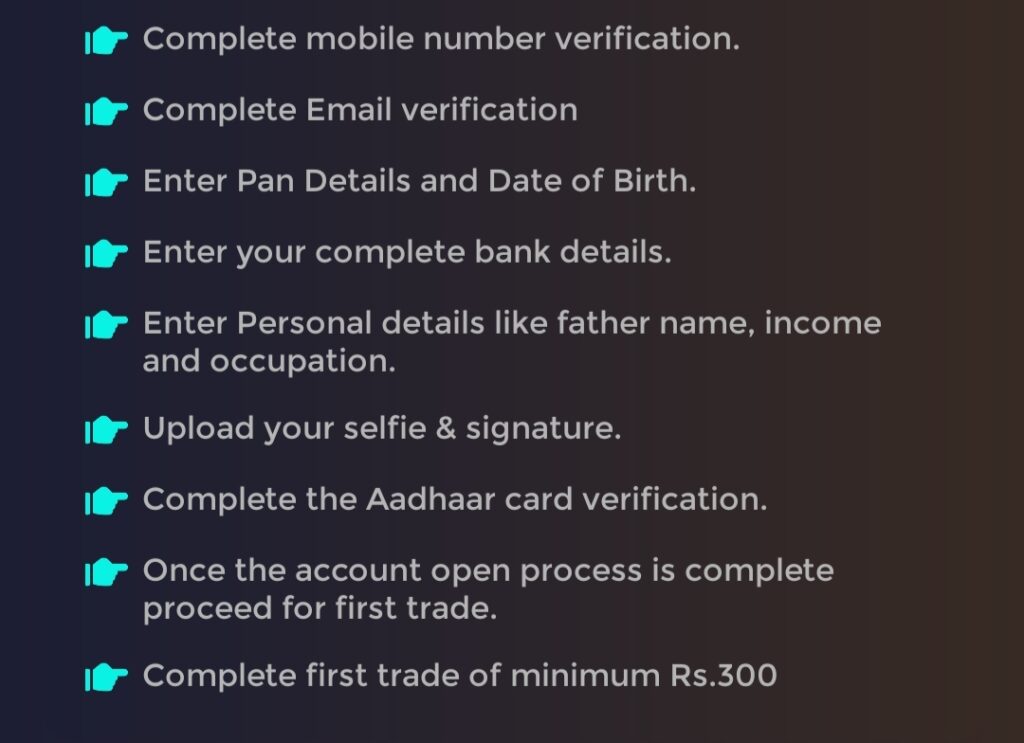

submit this 👆 detail and click to proceed and follow this process 👇

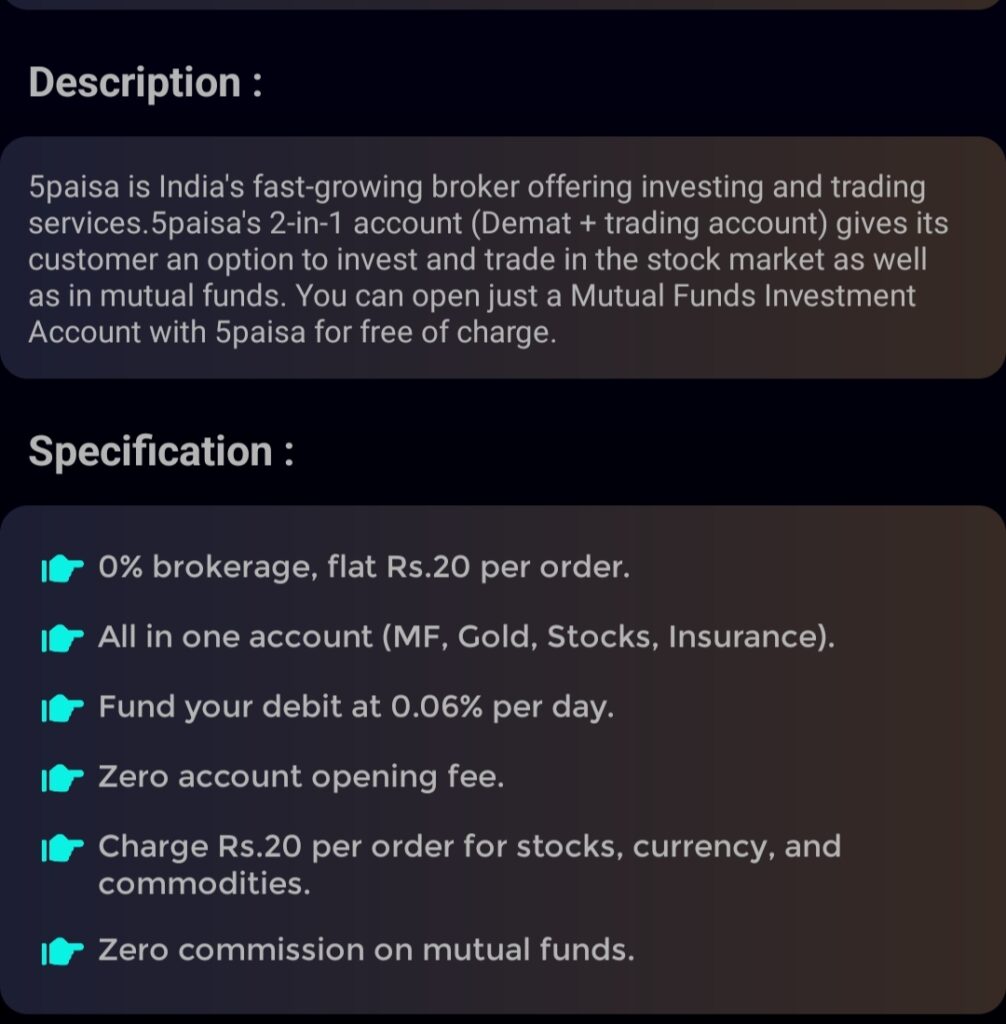

II. Why Choose 5 Paisa?

A. Low Brokerage Fees

5 Paisa stands out in the market for its competitive brokerage fees, making it a cost-effective option for traders. With lower transaction costs, investors can maximize their returns.

B. User-Friendly Interface

Navigating through the complexities of the stock market can be daunting, but 5 Paisa simplifies the process with its intuitive and user-friendly interface. Even beginners can quickly adapt to the platform.

C. Variety of Investment Options

From stocks to mutual funds and commodities, 5 Paisa offers a diverse range of investment opportunities. This flexibility allows investors to tailor their portfolios to match their financial goals.

III. Step-by-Step Guide to Creating a 5 Paisa Account

A. Visit the Official Website

To begin the journey with 5 Paisa, visit the official website here. The homepage provides a clear call-to-action button to “Open an Account.”

B. Click on the ‘Open an Account’ Button

Once on the website, locate and click on the ‘Open an Account’ button. This initiates the account creation process.

C. Choose the Account Type

Select the type of account you wish to open—Trading Account, Demat Account, or both. Each account type serves a specific purpose, so choose based on your investment preferences.

D. Fill in Personal Details

Enter your personal details, including name, contact information, PAN card number, and Aadhar card details. Ensure accuracy to expedite the verification process.

E. Verification Process

5 Paisa follows a robust verification process to comply with regulatory requirements. This may involve document submission and in-person verification.

F. Setting Up a Trading Account

Once verified, proceed to set up your trading account. Choose preferences such as margin trading and other features according to your risk appetite.

G. Funding Your Account

To start trading, fund your 5 Paisa account. The platform supports various payment methods, ensuring flexibility for users.

H. Explaining the KYC Process

5 Paisa’s Know Your Customer (KYC) process is a crucial step for security and regulatory compliance. Understand the KYC requirements and complete the process promptly.

IV. Understanding the 5 Paisa Dashboard

A. Navigating Through the Dashboard

The 5 Paisa dashboard is designed for ease of use. Familiarize yourself with the layout, menu options, and quick links for efficient navigation.

B. Overview of Key Features

Explore the key features available on the dashboard, such as real-time market data, watchlists, and order placement. Understanding these features enhances your trading experience.

C. Customizing Your Dashboard

Personalize your dashboard by adding widgets and customizing the layout. Tailor it to suit your preferences and keep essential information at your fingertips.

V. Tips for a Successful 5 Paisa Experience

A. Staying Updated with Market Trends

Regularly monitor market trends and news updates. Staying informed helps you make informed decisions and adapt your investment strategy.

B. Utilizing Analytical Tools

5 Paisa provides analytical tools for technical and fundamental analysis. Leverage these tools to assess market trends, stock performance, and potential investment opportunities.

C. Diversifying Your Investment Portfolio

Mitigate risk by diversifying your investment portfolio. Explore different asset classes and industries to ensure a well-balanced and resilient portfolio.

VI. Troubleshooting Common Issues

A. Password Recovery

In case of a forgotten password, use the platform’s password recovery feature. Follow the prompts to reset your password securely.

B. Technical Support Options

If you encounter technical issues, 5 Paisa offers various support channels, including a helpline, email support, and online chat. Reach out for prompt assistance.

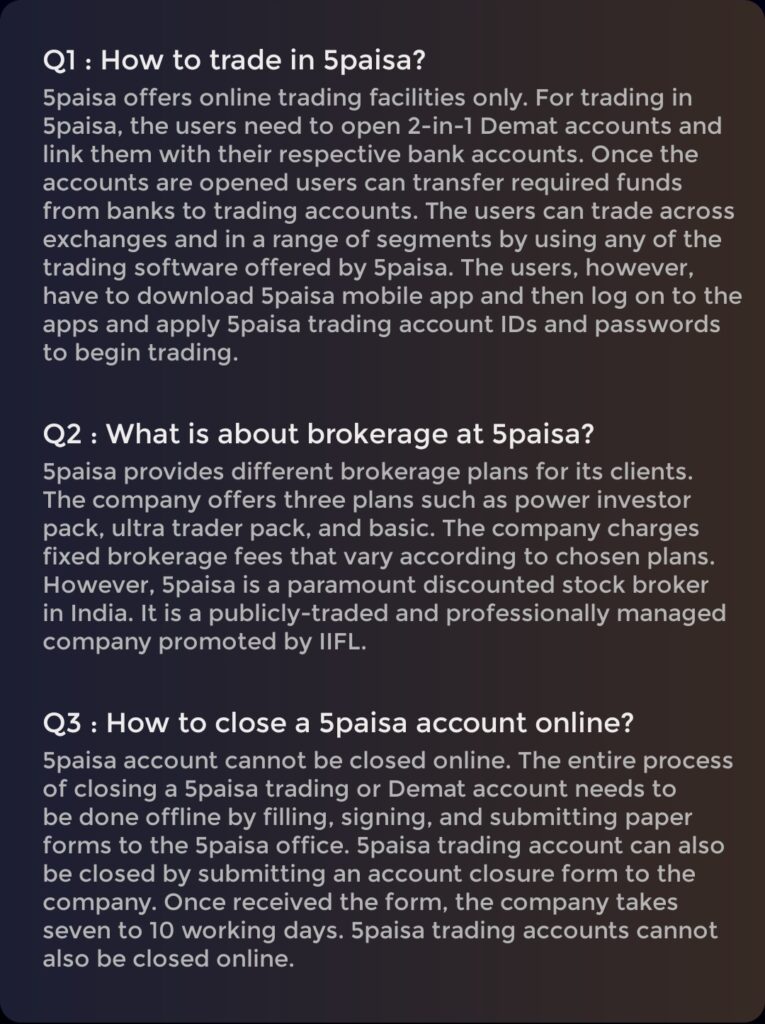

C. Frequently Encountered Problems

Be aware of common issues such as order execution delays or connectivity problems. Familiarize yourself with solutions to address these challenges swiftly.

VII. Security Measures on 5 Paisa

A. Two-Factor Authentication

Enhance the security of your 5 Paisa account by enabling two-factor authentication. This additional layer of protection safeguards your account from unauthorized access.

B. Secure Login Practices

Follow best practices for secure login, such as creating a strong password and avoiding public computers for accessing your account.

C. Safeguarding Financial Information

Exercise caution with financial information. Be wary of phishing attempts and only use secure networks for transactions.

VIII. Advantages of Using 5 Paisa Mobile App

A. Convenience of Trading on the Go

The 5 Paisa mobile app extends the platform’s functionality to your fingertips, allowing you to trade anytime, anywhere.

B. Mobile App Features and Functionalities

Explore the features of the mobile app, including real-time market updates, order placement, and portfolio tracking.

C. Seamless User Experience

The mobile app offers a seamless and responsive user experience. Enjoy the convenience of trading on your smartphone with ease.

IX. Real-Life Success Stories

A. Interviews with Successful Investors

Learn from the experiences of successful investors who have thrived using 5 Paisa. Gain insights into their strategies and decision-making processes.

B. Learning from Their Strategies

Identify common patterns and strategies employed by successful investors. Apply these insights to refine your own investment approach.

X. How 5 Paisa is Revolutionizing Online Trading

A. Technological Advancements

Explore the technological innovations implemented by 5 Paisa to provide a cutting-edge trading experience.

B. Integration of AI in Trading

Understand how artificial intelligence is integrated into the platform to enhance market analysis and decision-making.

C. Future Prospects of Online Trading

Consider the evolving landscape of online trading and the potential future developments that may impact investors on the 5 Paisa platform.

XI. Trading Strategies for Beginners

A. Understanding Market Orders

For novice investors, comprehending market orders is crucial. Learn the basics of placing buy and sell orders at prevailing market prices to make informed decisions.

B. Setting Stop-Loss and Take-Profit Levels

Mitigate risks by implementing stop-loss orders to limit potential losses and take-profit levels to secure profits. These strategies are essential for safeguarding your investments.

C. Dollar-Cost Averaging Technique

Explore the benefits of dollar-cost averaging, a strategy that involves regularly investing a fixed amount. This approach helps reduce the impact of market volatility over time.

XII. Advanced Features of 5 Paisa

A. Margin Trading and Leverage

For experienced traders, understanding margin trading and leverage is vital. Explore how these features can amplify returns but also increase risk.

B. Options and Futures Trading

Dive into the world of derivatives with options and futures trading. Learn the fundamentals of these advanced financial instruments and their potential benefits.

C. Algorithmic Trading on 5 Paisa

Discover the possibilities of algorithmic trading on 5 Paisa, where automated systems execute predefined trading strategies. Understand how this advanced feature can optimize your trading.

XIII. Community and Social Trading

A. Connecting with Like-Minded Investors

Explore the community aspect of 5 Paisa, where investors can connect, share insights, and discuss strategies. Engaging with a community provides valuable perspectives and knowledge.

B. Social Trading Platforms Integration

Learn about social trading platforms integrated with 5 Paisa, allowing users to replicate trades of successful investors automatically. Understand how this collaborative approach can enhance your trading experience.

XIV. Tax Implications of Trading on 5 Paisa

A. Capital Gains and Tax Liabilities

Understand the tax implications of your trades, including capital gains and tax liabilities. Familiarize yourself with the documentation required for tax filing.

B. Tax-Saving Investment Options

Explore tax-saving investment options available on 5 Paisa, such as Equity-Linked Savings Schemes (ELSS) and other tax-efficient investment avenues.

XV. Continuous Learning and Updates

A. Staying Informed with Educational Resources

Utilize the educational resources provided by 5 Paisa, including webinars, tutorials, and market insights. Continuous learning is key to evolving as an investor.

B. Keeping Up with Platform Updates

Stay updated with the latest features and improvements on the 5 Paisa platform. Regularly check for updates to ensure you leverage all available tools.

XVI. Mastering Technical Analysis

A. Introduction to Technical Analysis

Delve into the world of technical analysis, a crucial skill for traders. Learn how to interpret charts, identify trends, and use technical indicators to make informed decisions.

B. Candlestick Patterns

Explore the significance of candlestick patterns in technical analysis. Understanding these patterns can provide insights into market sentiment and potential price movements.

C. Trendlines and Support/Resistance Levels

Master the art of drawing trendlines and identifying support/resistance levels. These tools aid in predicting price movements and determining optimal entry and exit points.

XVII. Risk Management Strategies

A. Importance of Risk Management

Highlight the significance of risk management in trading. Discuss the role of stop-loss orders, position sizing, and diversification in minimizing potential losses.

B. Calculating Risk-Reward Ratios

Guide readers on how to calculate risk-reward ratios when entering a trade. Emphasize the importance of maintaining a favorable risk-reward balance for long-term success.

C. Emotional Control in Trading

Address the psychological aspect of trading, emphasizing the importance of emotional control. Provide tips on how to stay disciplined and avoid impulsive decisions.

XVIII. Market Psychology and Sentiment Analysis

A. Understanding Market Psychology

Discuss the impact of human behavior on market movements. Explore the concepts of fear, greed, and market sentiment and their influence on trading decisions.

B. Utilizing Sentiment Analysis Tools

Introduce readers to sentiment analysis tools available on 5 Paisa. These tools help gauge the overall market sentiment and make data-driven decisions.

XIX. Exploring Advanced Chart Patterns

A. Head and Shoulders Pattern

Explain the head and shoulders chart pattern and its significance in predicting trend reversals. Provide examples and insights into how traders can utilize this pattern.

B. Double Tops and Bottoms

Discuss the double tops and bottoms chart patterns and their implications. Guide readers on how to identify and interpret these patterns for effective trading.

C. Cup and Handle Pattern

Explore the cup and handle pattern, a continuation pattern in technical analysis. Illustrate how traders can use this pattern to anticipate future price movements.

XX. Leveraging 5 Paisa’s Research Tools

A. Fundamental Research on Stocks

Showcase the fundamental research tools provided by 5 Paisa. Explore how investors can analyze financial statements, earnings reports, and other fundamentals.

B. Real-Time Market News and Updates

Highlight the importance of staying informed with real-time market news. Discuss how 5 Paisa’s platform provides timely updates to assist traders in making informed decisions.

XXI. Navigating Market Volatility

A. Embracing Market Fluctuations

Guide investors on navigating market volatility with confidence. Discuss strategies to capitalize on opportunities during turbulent times and how to adapt to changing market conditions.

B. Defensive Investing Techniques

Explore defensive investing techniques to protect your portfolio during market downturns. Diversification, hedging, and conservative asset allocation are key components.

C. Utilizing 5 Paisa’s Risk Management Tools

Highlight the risk management tools available on the 5 Paisa platform. These tools can aid in setting automated stop-loss orders and managing risk effectively.

XXII. Cryptocurrency Trading on 5 Paisa

A. Introduction to Cryptocurrency Trading

Delve into the world of cryptocurrency trading on 5 Paisa. Discuss the available cryptocurrencies, trading pairs, and the unique considerations when trading digital assets.

B. Risk and Rewards of Cryptocurrency

Examine the risks and rewards associated with cryptocurrency trading. Provide insights into the volatility of the crypto market and how investors can navigate this space.

C. Integrating Cryptocurrencies into Your Portfolio

Discuss the potential benefits of integrating cryptocurrencies into an investment portfolio. Explore diversification strategies that include digital assets.

XXIII. Leveraging Machine Learning in Trading

A. Machine Learning Applications in Trading

Explore the applications of machine learning in trading on 5 Paisa. Discuss how algorithms and predictive modeling can enhance decision-making.

B. Algorithmic Trading Strategies

Introduce readers to algorithmic trading strategies. Discuss the advantages of automated trading and how traders can leverage pre-programmed algorithms.

C. Risks and Ethical Considerations

Highlight the potential risks and ethical considerations associated with machine learning in trading. Emphasize the importance of responsible and transparent use of algorithms.

XXIV. Exploring Social Impact Investing

A. Understanding Social Impact Investing

Introduce the concept of social impact investing and how it goes beyond financial returns. Discuss how investors can align their values with their investment choices.

B. Investment Opportunities with Positive Social Impact

Highlight investment opportunities that contribute to positive social change. Showcase companies and sectors that focus on sustainability, environmental responsibility, and social welfare.

C. 5 Paisa’s Approach to Social Impact Investing

Explore 5 Paisa’s initiatives in supporting social impact investing. Discuss any partnerships or features that cater to investors with a focus on positive social outcomes.

XXV. Staying Ahead with Continuous Education

A. Lifelong Learning in Finance

Emphasize the importance of continuous education in the dynamic field of finance. Encourage readers to explore courses, webinars, and certifications to stay updated.

B. 5 Paisa’s Educational Resources

Highlight the educational resources offered by 5 Paisa. Discuss how the platform supports users in enhancing their financial literacy and trading skills.

XXVI. Mastering Portfolio Rebalancing

A. Importance of Portfolio Rebalancing

Discuss the significance of periodically rebalancing investment portfolios. Explore how this practice helps maintain the desired risk-return profile over time.

B. Assessing Asset Allocation

Guide investors on assessing their current asset allocation and making informed decisions about rebalancing. Emphasize the impact of market changes on the original allocation.

C. Using 5 Paisa Tools for Portfolio Analysis

Highlight the tools provided by 5 Paisa for portfolio analysis. Illustrate how users can leverage these tools to evaluate their current portfolio composition.

XXVII. Exploring Sector-Specific Investments

A. Identifying Promising Sectors

Discuss the importance of staying informed about sector-specific trends. Provide insights into how investors can identify sectors with growth potential.

B. Investing in Emerging Industries

Explore opportunities in emerging industries and technologies. Discuss how investors can position themselves in sectors poised for significant advancements.

C. Monitoring Economic Indicators

Guide readers on monitoring economic indicators that influence specific sectors. Understanding these indicators can aid in making informed investment decisions.

XXVIII. Advanced Options Trading Strategies

A. Hedging with Options

Discuss advanced options trading strategies, including using options for hedging purposes. Explain how options can act as insurance against market downturns.

B. Butterfly Spread and Iron Condor Strategies

Introduce more complex options strategies like butterfly spread and iron condor. Provide insights into how these strategies can generate income and manage risk.

C. Understanding Implied Volatility

Explore the concept of implied volatility in options trading. Guide investors on how to interpret and use implied volatility to their advantage.

XXVIII. Real-Time Trading Case Studies

A. Analyzing Successful Trades

Present real-time case studies of successful trades made on the 5 Paisa platform. Break down the decision-making process and outcomes for educational purposes.

B. Learning from Mistakes

Explore instances where trades did not go as planned. Discuss the lessons learned from mistakes and how traders can avoid similar pitfalls.

C. Adapting Strategies to Market Conditions

Highlight the importance of adaptability in trading strategies based on evolving market conditions. Showcase examples of traders adjusting their approaches successfully.

XXIX. Building a Long-Term Investment Strategy

A. Setting Financial Goals

Guide investors on setting clear financial goals aligned with their risk tolerance and time horizon. Discuss the role of these goals in shaping a long-term investment strategy.

B. Diversification for Long-Term Success

Emphasize the benefits of a diversified long-term investment portfolio. Discuss how diversification mitigates risks and enhances overall stability.

C. Reinvesting Dividends and Compounding

Explore the power of reinvesting dividends and compounding returns over the long term. Illustrate how these practices contribute to wealth accumulation.

XXX. The Role of Robo-Advisors in Investing

A. Introduction to Robo-Advisors

Discuss the role of robo-advisors in modern investing. Explain how these automated platforms provide algorithm-driven portfolio management.

B. Benefits and Limitations of Robo-Advisors

Highlight the benefits, such as cost-effectiveness and accessibility, as well as limitations, such as lack of personalization, associated with robo-advisors.

C. Integrating Robo-Advisors with 5 Paisa

Explore any integration or collaboration between 5 Paisa and robo-advisory services. Discuss how users can seamlessly incorporate automated investing into their strategies.

XXXI. Exploring Advanced Technical Analysis

A. Fibonacci Retracement and Extension

Delve into advanced technical analysis with the Fibonacci retracement and extension tools. Discuss how traders can use these tools to identify potential support and resistance levels.

B. Elliott Wave Theory

Introduce traders to the Elliott Wave Theory, a method for analyzing market cycles. Explore the principles behind this theory and how it can be applied to make more informed trading decisions.

C. Ichimoku Cloud Analysis

Discuss the use of the Ichimoku Cloud, a comprehensive technical analysis tool. Explore its components and how it can assist traders in identifying trend direction, support, and resistance.

XXXII. In-Depth Fundamental Analysis

A. Earnings Reports and Ratios

Guide investors through the process of analyzing earnings reports and financial ratios. Discuss key indicators such as price-to-earnings ratio (P/E) and earnings per share (EPS).

B. Dividend Analysis

Explore the importance of dividend analysis for income-focused investors. Discuss how to assess a company’s dividend history, yield, and sustainability.

C. Economic Indicators and Market Impact

Examine how economic indicators, such as GDP growth and unemployment rates, can impact the financial markets. Discuss strategies for incorporating economic data into investment decisions.

XXXIII. Risk Hedging Strategies

A. Options for Risk Hedging

Discuss various options strategies that investors can employ for risk hedging. Explore protective puts, collars, and other approaches to mitigate potential losses.

B. Gold and Precious Metals as Hedges

Explore the role of gold and other precious metals as traditional hedges against market volatility. Discuss the factors influencing their value during economic uncertainties.

C. Using 5 Paisa Tools for Risk Management

Highlight specific risk management tools available on the 5 Paisa platform. Illustrate how users can set up alerts, monitor positions, and implement risk mitigation strategies.

XXXIV. Sustainable Investing on 5 Paisa

A. ESG Criteria in Investing

Introduce the concept of Environmental, Social, and Governance (ESG) criteria in investing. Discuss how investors can align their values with sustainable and socially responsible companies.

B. Green Investments and Clean Energy

Explore investment opportunities in green sectors and clean energy. Discuss how sustainable investments can provide financial returns while contributing to environmental goals.

C. 5 Paisa’s Support for Sustainable Investing

Highlight any initiatives or features on the 5 Paisa platform that cater to investors interested in sustainable and socially responsible investing.

XXXV. Real-Time Market Analysis

A. Live Market Data and Quotes

Discuss the importance of real-time market data for making timely and informed decisions. Explore how traders can access live quotes and data on the 5 Paisa platform.

B. Technical Analysis Webinars

Highlight any technical analysis webinars provided by 5 Paisa. Encourage users to participate in these sessions for deeper insights into market trends and analysis.

XXXVI. The Role of Community in Trading

A. Online Trading Communities

Discuss the benefits of joining online trading communities. Explore how investors can share insights, strategies, and experiences with like-minded individuals.

B. 5 Paisa Community Features

Highlight any community features or forums within the 5 Paisa platform. Discuss how users can engage with fellow traders to enhance their trading experience.

XXXVII. Personal Finance and Wealth Management

A. Financial Planning Strategies

Guide investors on effective financial planning strategies. Discuss budgeting, savings, and goal-setting to achieve long-term financial success.

B. Wealth Management Services on 5 Paisa

Explore any wealth management services offered by 5 Paisa. Discuss how users can leverage these services for personalized financial guidance.

XXXVIII. Leveraging Machine Learning for Market Predictions

A. Predictive Analytics in Trading

Explore how machine learning techniques can be used for predictive analytics in the financial markets. Discuss the potential of algorithms to analyze historical data and forecast future trends.

B. Machine Learning Models on 5 Paisa

Highlight any machine learning models or tools integrated into the 5 Paisa platform. Discuss how users can leverage these advanced technologies for more accurate market predictions.

C. Machine Learning Risks and Safeguards

Acknowledge the risks associated with machine learning in trading, such as over-reliance on historical data. Provide insights into safeguards and considerations for responsible use.

XXXIX. Cryptocurrency Investing Strategies

A. Long-Term vs. Short-Term Cryptocurrency Investing

Discuss the differences between long-term and short-term strategies for investing in cryptocurrencies. Explore the factors that influence the choice of investment horizon.

B. Diversification in Cryptocurrency Portfolios

Explore the importance of diversifying cryptocurrency portfolios. Discuss the various types of cryptocurrencies and how investors can spread their risk.

C. Risk Management in Cryptocurrency Markets

Highlight the unique risks in cryptocurrency markets and effective risk management strategies. Discuss the volatility of the crypto space and ways to mitigate potential losses.

XL. 5 Paisa’s Support for Algorithmic Trading

A. Algorithmic Trading Features

Discuss the specific features on the 5 Paisa platform that support algorithmic trading. Explore how users can automate their trading strategies for efficiency.

B. Customizing Algorithms on 5 Paisa

Guide users on how to customize and implement their own algorithms on the 5 Paisa platform. Discuss the flexibility and options available for algorithm customization.

C. Algorithmic Trading Success Stories

Share success stories of traders who have achieved positive results using algorithmic trading on 5 Paisa. Provide real-world examples to inspire and educate users.

XLI. Advanced Trading Psychology

A. Emotional Discipline in Trading

Emphasize the role of emotional discipline in advanced trading. Discuss techniques for managing emotions during market fluctuations and unexpected events.

B. Psychological Resilience

Explore the concept of psychological resilience in trading. Discuss how traders can bounce back from losses and setbacks with a positive mindset.

C. Mindfulness in Trading

Introduce mindfulness practices as tools for maintaining focus and clarity in trading. Discuss how techniques like meditation can positively impact decision-making.

XLII. Exploring Niche Markets and Alternative Investments

A. Niche Market Opportunities

Discuss opportunities in niche markets that might be overlooked by mainstream investors. Explore sectors such as renewable energy, biotech, or emerging technologies.

B. Alternative Investments on 5 Paisa

Explore any alternative investment options available on the 5 Paisa platform. Discuss the advantages and considerations of diversifying into non-traditional assets.

C. Risks and Rewards of Niche Investments

Provide insights into the risks and rewards associated with investing in niche markets. Discuss the importance of thorough research before entering these specialized areas.

XLIII. Financial Planning for Retirement

A. Importance of Retirement Planning

Discuss the significance of early retirement planning. Emphasize the benefits of compounding and the need for a well-thought-out strategy.

B. Retirement Investment Vehicles

Explore various investment vehicles suitable for retirement planning, such as pension plans, annuities, and tax-efficient investment accounts.

C. Tailoring Retirement Plans on 5 Paisa

Highlight features on the 5 Paisa platform that cater specifically to retirement planning. Discuss how users can tailor their investment strategies to meet long-term retirement goals.

XLVI. Community-Led Trading Strategies

A. Collective Intelligence in Trading

Explore the concept of collective intelligence in trading communities. Discuss how collaborative efforts can lead to better-informed trading decisions.

B. Crowd-Sourced Investment Ideas

Highlight the benefits of crowd-sourced investment ideas within trading communities. Discuss how users can tap into collective wisdom for market insights.

XLV. Continuous Learning in the Dynamic Market

A. Adaptive Learning Strategies

Discuss adaptive learning strategies for staying ahead in the dynamic financial market. Emphasize the need for continuous education and skill development.

B. 5 Paisa’s Commitment to User Education

Highlight any initiatives or programs on 5 Paisa that support user education. Discuss how the platform contributes to the ongoing learning journey of its users.

XLVI. Conclusion

In conclusion, the journey of mastering trading and investing on 5 Paisa is an ever-evolving process. From cutting-edge technologies like machine learning to niche market exploration and retirement planning, the platform provides a robust ecosystem for investors at all levels.

XLVII. FAQs

A. How Can I Monitor Algorithmic Trading Performance on 5 Paisa?

Explore the performance tracking features on 5 Paisa for algorithmic trading. Discuss metrics and analytics tools available to assess the effectiveness of algorithms.

B. Are There Educational Webinars on Advanced Trading Strategies?

Check the 5 Paisa webinar section for sessions on advanced trading strategies. Participate in these webinars to enhance your understanding of sophisticated trading techniques.

C. Can I Receive Alerts for Algorithmic Trading Events?

Yes, 5 Paisa typically provides alert features for various events, including those related to algorithmic trading. Set up personalized alerts to stay informed about your trading activities.

D. How Does 5 Paisa Support Retirement Planning?

Explore retirement planning tools on 5 Paisa, such as calculators and investment options with a focus on long-term growth. Tailor your investments to align with your retirement goals.

E. Is There a Forum for Discussing Niche Investment Opportunities on 5 Paisa?

Check for niche investment forums or discussion groups on the 5 Paisa platform. Engage with other investors to explore and discuss unique investment opportunities.

F. Can I Trade International Stocks on 5 Paisa?

As of my last update in January 2022, 5 Paisa primarily focuses on domestic markets. Check the platform for any updates regarding the availability of international stocks.

G. What Research Tools Does 5 Paisa Offer for Stock Analysis?

Explore the various research tools on 5 Paisa, including stock screeners, analyst recommendations, and financial reports. Utilize these tools for comprehensive stock analysis.

H. Are There Any Advanced Charting Features on 5 Paisa?

Yes, 5 Paisa offers advanced charting features, including technical indicators and customizable chart layouts. Experiment with these features to enhance your technical analysis.

I. How Can I Transfer Funds to My 5 Paisa Account?

Navigate to the funding section on the 5 Paisa platform to explore different fund transfer options, such as UPI, net banking, or other available methods.

J. Is There a Mobile App Tutorial for Advanced Trading Features?ho

Check the 5 Paisa mobile app tutorial section for guidance on utilizing advanced trading features. The app tutorial can be a valuable resource for mastering mobile trading.

Visit the provided link to access exclusive benefits and continue your journey of exploration and growth with 5 Paisa. Happy investing!