Adani Power stands as a prominent player in the energy sector, operating within India as part of the esteemed Adani Group. Its core focus lies in the generation of power through various thermal plants strategically positioned across the nation. With a commitment to providing reliable and affordable electricity, Adani Power serves diverse sectors, contributing significantly to the country’s energy landscape. in this article full explain adani power share price.

Table of Contents

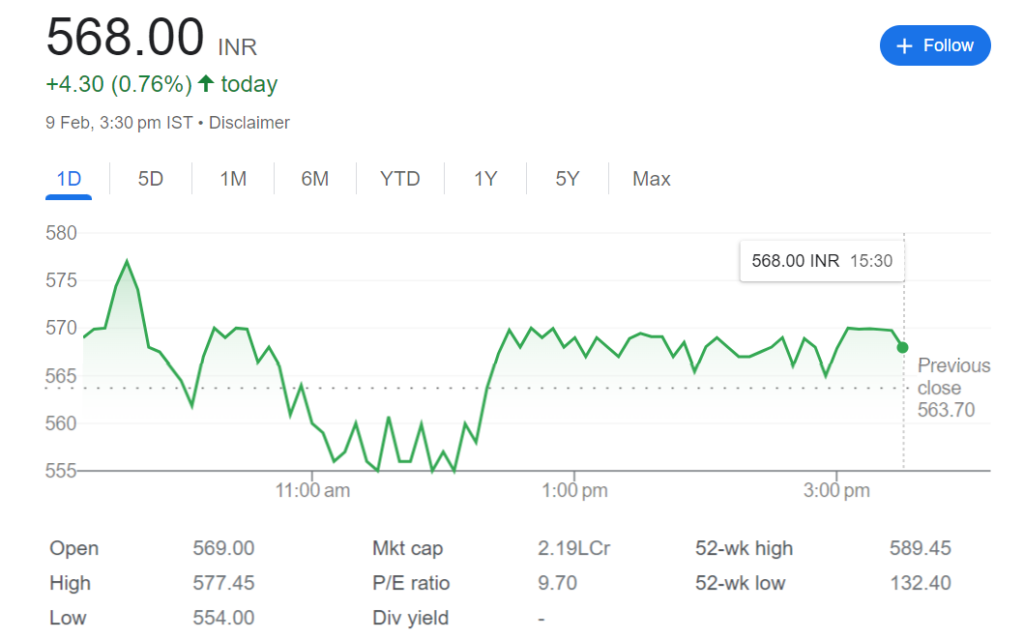

adani power share price live click here

Understanding Share Price

Share price comprehension is pivotal for investors navigating the stock market. It denotes the value at which a company’s shares are traded, reflecting the market’s perception of its performance and potential. Numerous factors influence share prices, ranging from fundamental company data to broader market trends and investor sentiment. By grasping the dynamics behind share prices, investors can make informed decisions, strategically managing their investments for optimal returns.

Factors Influencing Adani Power Share Price

Market Trends

Market trends, including overall market sentiment and sector-specific trends in the power industry, play a significant role in determining Adani Power’s share price.

Company Performance

The financial performance of Adani Power, including revenue growth, profitability, and operational efficiency, directly impacts its share price.

Economic Conditions

Macroeconomic factors such as GDP growth, inflation rates, and interest rates influence investor confidence and, consequently, Adani Power’s share price.

Recent Developments in Adani Power

Recent developments, such as new project launches, acquisitions, or regulatory changes, can significantly impact Adani Power’s share price.

Impact of Regulatory Changes

Changes in government policies, regulations, or environmental norms can affect Adani Power’s operations and, consequently, its share price.

Investor Sentiment towards Adani Power

Investor sentiment towards Adani Power, a subsidiary of the Adani Group focused on power generation and distribution, has been somewhat mixed in recent times. Adani Power has faced scrutiny and volatility due to various factors, including regulatory challenges, changes in government policies, and market dynamics.

On one hand, some investors may view Adani Power as a promising investment opportunity due to its significant presence in India’s power sector, which continues to experience growth and demand. The company’s expansion plans, technological advancements, and strategic partnerships could be seen as positive indicators for future growth potential.

However, there are also concerns that may impact investor sentiment. These include regulatory uncertainties, such as changes in environmental policies and regulations governing the power sector, which could affect Adani Power’s operations and profitability. Additionally, the company’s heavy reliance on coal-based power generation may raise environmental and sustainability concerns among investors, particularly in an era of increasing focus on renewable energy sources.

Furthermore, broader market factors and geopolitical tensions could also influence investor sentiment towards Adani Power, as the company’s fortunes may be tied to economic conditions and government policies both domestically and internationally.

Overall, investor sentiment towards Adani Power is likely to be influenced by a combination of these factors, and investors may weigh the potential risks and opportunities carefully before making investment decisions.

Analyst Recommendations

Analyst recommendations and reports assessing Adani Power’s fundamentals and growth prospects can influence investor decisions and, consequently, its share price.

Long-term Outlook for Adani Power

The long-term outlook for Adani Power, like any company operating in the power sector, is subject to various factors that can influence its performance and growth prospects.

- Energy Transition Trends: Adani Power’s long-term outlook will be significantly impacted by global energy transition trends. As the world shifts towards cleaner and renewable sources of energy, the company may face challenges in its reliance on coal-based power generation. Adapting to these trends by diversifying its energy portfolio and investing in renewable energy infrastructure could be crucial for its sustainability in the long run.

- Government Policies and Regulations: Government policies and regulations play a critical role in shaping the power sector landscape. Adani Power’s long-term prospects will be influenced by regulatory frameworks governing electricity generation, distribution, and pricing. Changes in policies related to environmental regulations, carbon emissions, and subsidies for renewable energy could impact the company’s operations and profitability.

- Infrastructure Development: India’s ongoing infrastructure development, including projects related to power generation, transmission, and distribution, can provide growth opportunities for Adani Power in the long term. The company’s ability to participate in and secure contracts for large-scale infrastructure projects will be key to its sustained growth and market competitiveness.

- Technological Advancements: Innovation and technological advancements in power generation and distribution could shape Adani Power’s long-term outlook. Embracing technologies such as smart grids, energy storage solutions, and digitalization can enhance operational efficiency, reduce costs, and improve the company’s overall competitiveness in the evolving energy landscape.

- Economic Growth and Demand: Adani Power’s long-term performance will also be influenced by broader economic factors and demand trends for electricity. Economic growth, urbanization, industrialization, and changes in consumer behavior will drive electricity demand, presenting opportunities for the company to expand its customer base and revenue streams.

- Financial Health and Capital Allocation: Maintaining a strong financial position and prudent capital allocation strategies will be essential for Adani Power to navigate through market uncertainties and invest in growth opportunities over the long term. Effective management of debt levels, operational costs, and cash flows will be critical for sustainable growth and value creation.

Overall, while Adani Power may face challenges in adapting to changing market dynamics and regulatory environments, strategic initiatives focused on renewable energy, technological innovation, and infrastructure development could position the company for long-term success in India’s evolving power sector.

Risks Associated with Adani Power Investment

Investing in Adani Power involves several risks that potential investors should carefully consider:

- Regulatory Risks: Adani Power operates in a highly regulated industry, and changes in government policies and regulations can significantly impact its operations and financial performance. Regulatory uncertainties regarding environmental norms, tariffs, and fuel supplies can create operational challenges and affect profitability.

- Market Risks: Adani Power’s financial performance is subject to market dynamics, including fluctuations in electricity demand, fuel prices, and competition from other power generation companies. Changes in market conditions, such as oversupply or shortage of electricity, can affect the company’s revenue and margins.

- Operational Risks: The efficient operation of power plants is crucial for Adani Power’s profitability. Operational risks such as equipment failures, supply chain disruptions, and workforce issues can lead to downtime, increased costs, and reputational damage.

- Financial Risks: Adani Power’s financial health is vulnerable to factors such as interest rate fluctuations, currency exchange rate movements, and debt levels. High debt burdens and interest expenses can strain the company’s cash flow and limit its ability to invest in growth initiatives or withstand economic downturns.

- Environmental and Social Risks: As a significant player in the coal-based power generation sector, Adani Power faces environmental and social risks related to carbon emissions, water usage, and community relations. Increasing scrutiny and regulations related to climate change and sustainability could impact the company’s operations and license to operate.

- Legal and Compliance Risks: Adani Power may be exposed to legal and compliance risks arising from litigation, regulatory investigations, or non-compliance with laws and regulations. Legal disputes or regulatory penalties can result in financial losses and reputational damage for the company.

- Geopolitical Risks: Adani Power’s operations may be influenced by geopolitical tensions, trade disputes, and changes in government policies both domestically and internationally. Political instability or regulatory changes in key markets can affect the company’s investment outlook and profitability.

- Technology Risks: Technological advancements and innovations in the energy sector could disrupt Adani Power’s traditional business model. Failure to adapt to emerging technologies such as renewable energy, energy storage, or smart grid solutions could erode the company’s competitive position over time.

Overall, investing in Adani Power involves inherent risks, and investors should conduct thorough due diligence, assess their risk tolerance, and consider seeking professional financial advice before making any investment decisions.

Strategies for Investing in Adani Power

Investing in Adani Power, or any company for that matter, requires careful consideration of various factors. Here are some strategies you may consider:

- Research the Company: Before investing in Adani Power, thoroughly research the company’s financial health, business model, management team, and future prospects. Understand its position in the power sector, its projects, and any potential risks it faces.

- Evaluate Industry Trends: Analyze the broader trends affecting the power sector. Consider factors such as government policies, regulatory environment, demand for electricity, and competition from renewable energy sources. Adani Power’s performance will be influenced by these external factors.

- Financial Analysis: Look at Adani Power’s financial statements, including its revenue, earnings, cash flow, and debt levels. Assess key financial ratios such as debt-to-equity ratio, return on equity, and operating margins to gauge its financial stability and profitability.

- Risk Management: Assess the risks associated with investing in Adani Power. These may include regulatory risks, operational risks, environmental risks, and macroeconomic risks. Diversify your investment portfolio to mitigate these risks.

- Long-Term Perspective: Consider investing in Adani Power with a long-term perspective. While short-term price fluctuations are inevitable, focus on the company’s long-term growth potential and ability to generate sustainable returns over time.

- Monitor News and Developments: Stay informed about news, developments, and announcements related to Adani Power. This includes updates on new projects, regulatory changes, financial results, and any significant events that could impact the company’s performance.

- Consult Financial Advisors: If you’re unsure about investing in Adani Power or any other stock, consider seeking advice from financial advisors or professionals who can provide personalized guidance based on your financial goals and risk tolerance.

- Consider Alternative Investments: Apart from investing directly in Adani Power’s stock, consider alternative investment options such as mutual funds or exchange-traded funds (ETFs) that focus on the energy sector. This can provide exposure to Adani Power along with other companies in the industry.

Remember that investing in stocks carries inherent risks, and it’s essential to conduct thorough research and exercise caution before making any investment decisions. Additionally, consider your own investment objectives, risk tolerance, and financial situation before investing in Adani Power or any other company.

Conclusion

In conclusion, Adani Power’s share price is subject to various internal and external factors, including market trends, company performance, regulatory changes, and investor sentiment. Understanding these factors is crucial for investors to make informed decisions.

FAQs

- Is investing in Adani Power a good idea?

- Investing in Adani Power can be lucrative for investors with a long-term horizon, given its position in the power sector and growth prospects. However, it’s essential to assess risks and conduct thorough research.

- What are the major risks associated with Adani Power?

- Major risks include regulatory changes, operational challenges, competition, and market volatility.

- How do regulatory changes affect Adani Power’s share price?

- Regulatory changes can impact Adani Power’s operations, costs, and profitability, thereby influencing investor perception and share price.

- What are analysts saying about Adani Power’s future?

- Analysts generally view Adani Power favorably, considering its growth potential and strategic initiatives. However, individual opinions may vary.

- How can investors minimize risks when investing in Adani Power?

- Investors can minimize risks by diversifying their portfolio, staying updated on company developments, and consulting financial experts.